This course addresses the following competence:

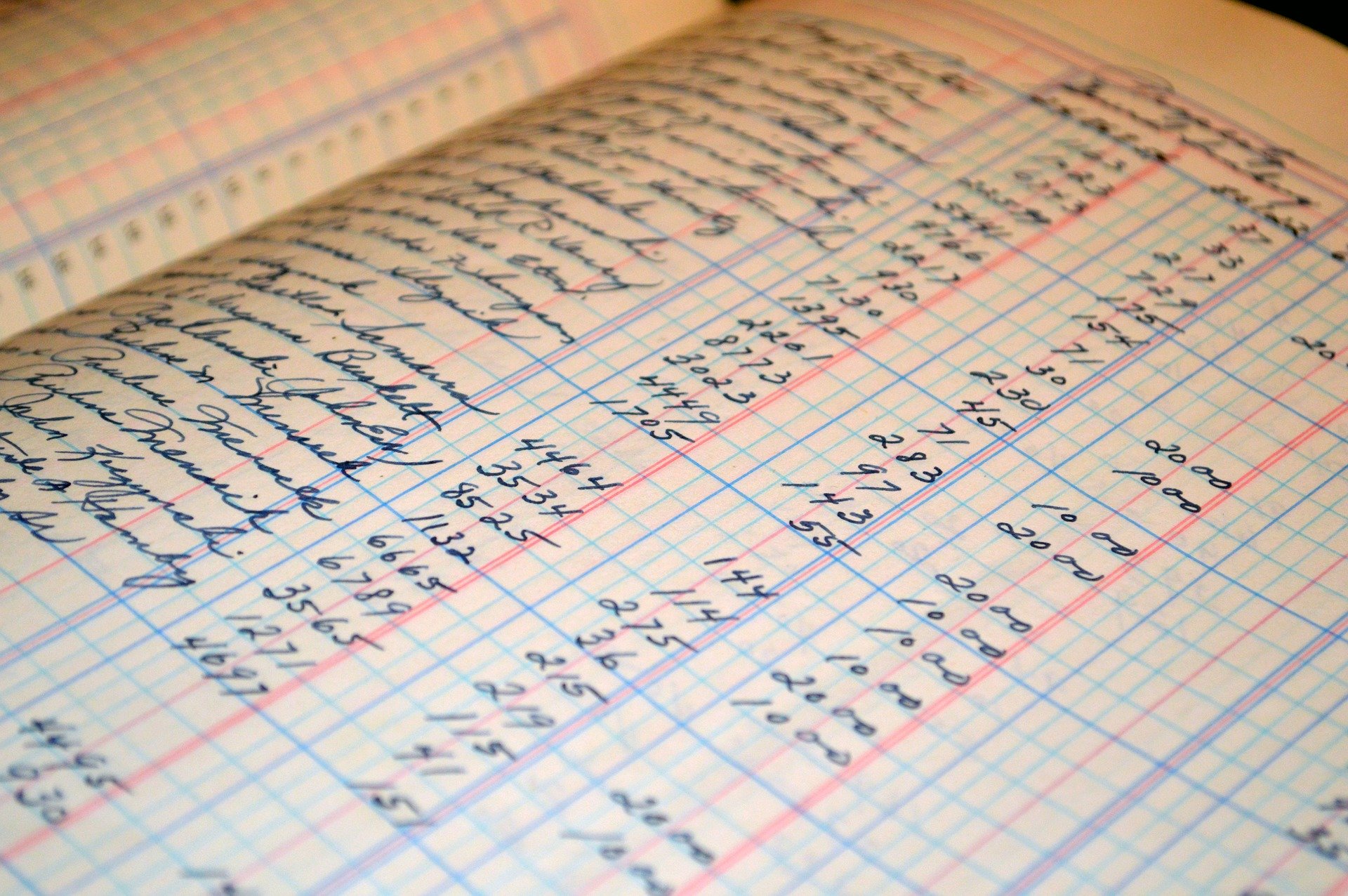

- Demonstrate a firm understanding of the fundamental principles of double-entry bookkeeping;

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner

This course addresses the following competence(s):

- Discuss and explain the main accounting concepts underpinning accounting practice and apply them to specific transactions and events;

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner

This course addresses the following competency:

- Distinguish between the cash and accruals approaches to accounting and explain the impact of the differences on an entity’s information requirements and accounting procedures

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner

This course addresses the following competency:

- Identify, explain and classify the main types of expenditure and income in an entity.

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner

This course addresses the following competency:

- Demonstrate an understanding of the methods and documentation used for recording, tracking and codifying transactions to support the bookkeeping process both manually and electronically;

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner

This course addresses the following competency:

- Create and maintain the primary financial records of an entity, carrying out such adjustments and reconciliations as are necessary.

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner

This course addresses the following competency:

- Applying the principles of double-entry bookkeeping, prepare a range of simple trial balances and financial statements from source financial data

- Teacher: Neo Hlatshwayo

- Teacher: Paseka Seleke

Module: Financial accounting

Skill Level: Beginner